SD Guthrie International (SDO) has entered into a strategic partnership with Abu Dhabi Vegetable Oil Company (ADVOC) to market oils and fats products in the Middle East and North Africa (MENA).

Reference: The Star

SD Guthrie International (SDO) has entered into a strategic partnership with Abu Dhabi Vegetable Oil Company (ADVOC) to market oils and fats products in the Middle East and North Africa (MENA).

Reference: The Star

Mohd Haris Mohd Arshad, Managing Director of SD Guthrie International session with BFM talks about the climate change implications of the palm oil industry.

Reference: BFM

The #GirangSenangRiang (Insta)nt Cook-Off is an internally held digital competition that gives SD Guthrie International and Sime Darby Plantation employees a chance to compete with their fellow colleagues. We at SD Guthrie International intend to introduce some fun in the kitchen with a team-oriented cooking competition by using our in-house products.

The competition provides an opportunity to showcase employees’ culinary flair, the ability to establish good teamwork between colleagues with the chance to win a grand prize of RM2,000 at the final table.

Reference: Instagram

Sime Darby Plantation (SDP) today published its ‘Working with Suppliers to Draw the Line on Deforestation’ policy statement to strengthen their commitment to achieve a sustainable supply chain.

The policy builds on SDP’s existing practice and maps a step forward to meet the No Deforestation, No Peat, No Exploitation (NDPE) standards as well as SDP’s expectation that suppliers adhere to those same standards.

SDP’s Group Managing Director, Mohamad Helmy Othman Basha said that the policy makes clear the action the Company will take when an issue is identified.

“The rapid rate of deforestation is an urgent challenge for the world that demands a meaningful response. As the leading producer of sustainable palm oil, SDP shares this concern. This policy was crafted to ensure that our suppliers provide us and others with deforestation-free palm oil, and at the same time improve their NDPE operational standards too,” he added.

Based on the policy, if a supplier is found to be in violation of SDP’s NDPE standards:

The development and execution of landscape restoration plans as well as operational improvement plans will be externally verified and monitored on an ongoing basis.

He said the ultimate goal is to expand the sphere of oil palm companies operating to NDPE standards. Therefore, if a non-compliant supplier commits to meet SDP’s conditions, the Company will re-engage with them and support their progress.

Helmy added that SDP does not believe in suspension without a path for the supplier to be reinstated.

“Constructive re-engagement to introduce new and improved practices is critical to systematically resolving non-compliance to NDPE. Simply suspending suppliers can have the unintended consequence of driving poor practice elsewhere into the system, making it less visible and harder to act on. This is not the intention of our policy. Our priority is to find solutions to the issues and we believe this must be done via engagement with the suppliers and giving them the opportunity to redress the problem,” Helmy stressed.

Helmy said SDP is committed to working with suppliers in the development of their plans, and with NGO partners to build capacity for operational improvements to raise suppliers’ NDPE compliance.

The policy comes on the heels of the launch of Crosscheck, SDP’s new open-access online tool that allows traceability of its palm oil supply chain right down to the mill level.

SDP firmly believes that the frontier to halting deforestation is traceability. By tracking supply back to its source, it is now easier to identify where problems exist – and to take action.

Through this tool, users can choose to view:

“The new policy will mirror the efforts we are putting forth through Crosscheck to drive deforestation out of our supply chain. Our hope is that, by working together with our suppliers, we can transform the palm oil industry and achieve our ambition to draw the line on deforestation,” Helmy said.

The new ‘Working with Suppliers to Draw the Line on Deforestation’ policy statement can be accessed via the weblink www.simedarbyplantation.com.

Malaysia’s Sime Darby Plantation Bhd., the world’s largest palm oil planter, is looking to buy refineries in Latin America as it grapples with poor margins and mounting costs at home.

The Kuala Lumpur-listed firm has Latin America “on the radar” as it looks to expand its global refining capacity, said Mohd Haris Mohd Arshad, the chief operating officer of the downstream business. It has set aside 400 million ringgit ($96 million) to invest in refineries, though more will be needed for acquisitions, and the company may consider turning to the debt market or listing its units’ shares, he said.

“If there are opportunities for us to acquire downstream assets in Latin America, we’ll be very keen,” Haris, who is also managing director of subsidiary SD Guthrie International, said in an interview. “This could potentially become an extension to our operations in Europe, and furthermore be an opportunity to expand into North America.”

The search for assets halfway across the world comes not only at a time when the industry is being plagued by weak palm prices, but also as intensifying global scrutiny over deforestation hamstrings the plantations that are predominantly in Southeast Asia. With Malaysia committing to stop expanding plantations, Sime Darby, the industry’s largest grower by acreage, has had to travel as far as Liberia and Papua New Guinea for more land to harvest.

Stymied Sales

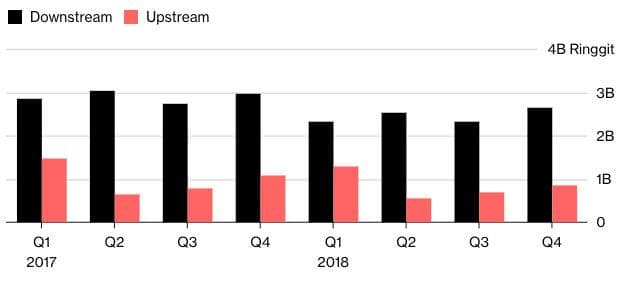

Sime Darby’s revenue from plantation operations is lagging behind

Source: Sime Darby Plantation, Bloomberg

“Those who are only focused on upstream with no outlets to markets are on the back foot,” Haris said. “The return on investment is not as great as it used to be, primarily because cost of land and labor is higher,” he said.

Haris expects palm prices to remain subdued in the next 12 months and trade near current levels, adding that anything above 2,500 ringgit a ton “is a bit of a stretch.” Benchmark futures have fallen about 20% since end-2017 and were trading at around 1,981 ringgit on Monday.

What Bloomberg Intelligence Says

“Stronger downstream earnings on higher palm oil refining margin will mitigate some of the weakness in its upstream plantation business. Upstream earnings are now only 1.9 times larger than downstream, compared with 9.0 times in the same quarter one year ago.” — Alvin Tai, agriculture analyst Click here to view the research

The appeal of Latin America is its proximity to Europe, the second-biggest buyer of palm oil, according to Haris. With Europe’s strict regulations on the quality of palm oil imports, the shorter sailing days from Latin America — 14 days versus 30 from Malaysia and 45 from Papua New Guinea — mean there’s less risk of harming the quality of the oil en route, he said. Colombia is currently the fourth-largest producer of palm, while Guatemala, Ecuador, Peru and Brazil also have some output.

The other hurdle for the industry is the fallout from the European Union’s move to limit palm oil use in biodiesel. From this month, a delegated act that restricts the types of biofuels from palm oil that may be counted toward the EU’s renewable-energy goals comes into effect. Indonesia and Malaysia, which supply 85 percent of the crop, have warned that they are ready to retaliate against what they see as “discriminatory” rules.

Read more: Palm Trade War Looms as Europe Sets Limits on Use in Biofuel

Haris says the impact from the EU’s decision is unlikely to spread and won’t seep into the food sector. Palm is the most widely used oil in consumer products, found in everything from breads to soaps to ice cream.

“What we’ll be left with in Europe is the core demand for palm,” he said. “It’ll be very difficult for consumers to actually move away from palm.”

Sime Darby Plantation Berhad (SDP), the world’s largest producer of Certified Sustainable Palm Oil (CSPO), today launched a new entity named SD Guthrie International (SDO) in the first ever rebranding of the company’s entire downstream division. Officiated by YB Teresa Kok, Minister of Primary Industries, the event which marked a significant milestone in SDP’s history, also unveiled SDO’s new corporate logo and corporate identity, its new domain name (www.simedarbyoils.com) along with its signature tagline ‘Realising possibilities, together’.

SDO aims to establish itself as a sustainable oils and fats multinational company that is involved in trading, manufacturing as well as sales and marketing of oils and fats products, palm oil-based biodiesel, nutraceuticals and other derivatives. The company has an extensive global network in eight countries – Malaysia, China, The Netherlands, United Kingdom, South Africa, Thailand, Indonesia and Papua New Guinea.

SD Guthrie International is poised to leverage on the huge potential of growth in the downstream sector of the Malaysian palm oil industry. As the second largest producer and exporter of palm oil and palm oil-based products, Malaysia has an important role to play in fulfilling the growing global demand for sustainably produced oils and fats. The palm oil industry is already an important pillar of the country’s economy, contributing RM44.8 billion or 3.8% of the country’s GDP in 2017. Malaysia also contributes 29% of the world’s palm oil production and 33% of the world’s palm oil exports.